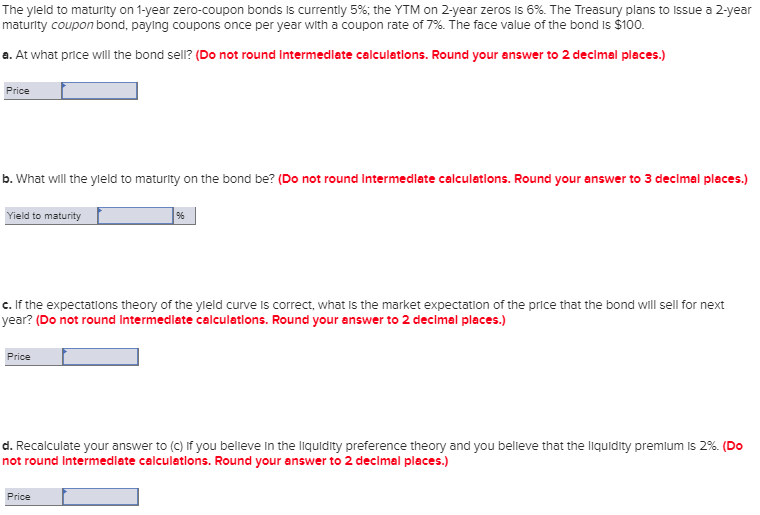

42 ytm for coupon bond

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bonds - Overview, Examples of Government and Corporate Bonds Yield/Yield to Maturity (YTM) - The annual rate of return of a bond that is held to maturity ... Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local governments or states are called municipal bonds. They come with a greater risk than federal government bonds but offer a ...

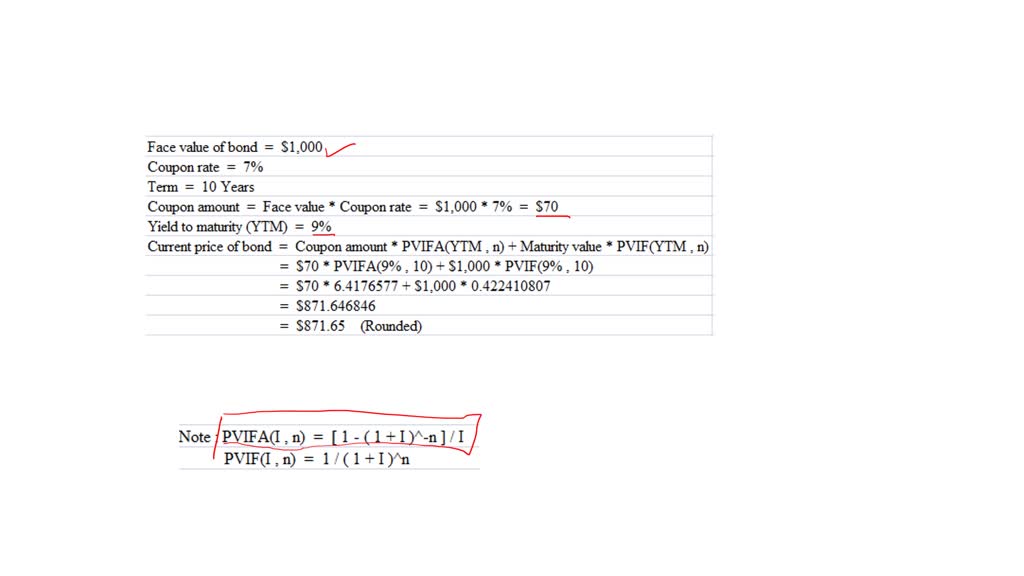

› bond-pricing-formulaBond Pricing Formula |How to Calculate Bond Price? - EDUCBA Let’s calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5% and yield is 8%. The maturity of the bond is 10 years Price of bond is calculated using the formula given below

Ytm for coupon bond

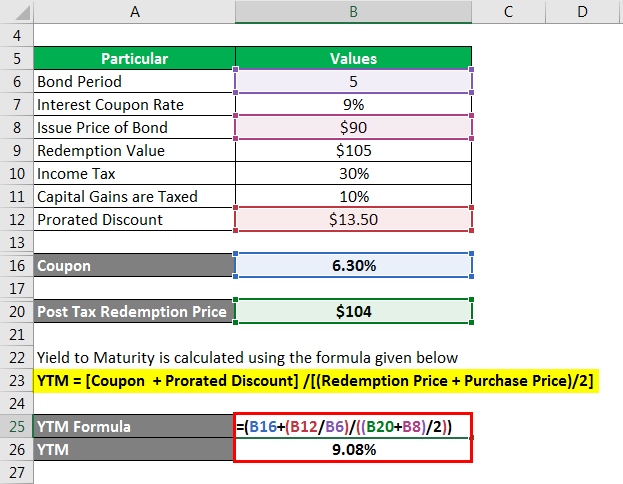

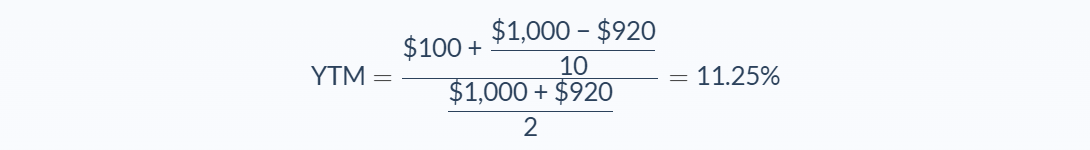

Difference Between Bond Yield and Yield to Maturity In short, a bond yield shows the annual income of investment, whereas yield to maturity is the total predicted yield on a bond till its date of maturation. Bond Yield, or commonly known as yield, designates the revenue return on the bond. In short, a bond yield is calculated by dividing coupon amount (interest) by the price. How to Calculate YTM of a Bond in Excel (4 Suitable Methods) 4. Utilize IRR Function to Calculate YTM of a Bond. Let's consider another dataset for this method. The dataset is shown in the next picture. I will use IRR Function to get the YTM value of a Bond.The IRR Function returns the internal rate of return by taking values from the dataset as arguments.Then, the YTM will be found after multiplying no of coupons per year with the IRR value. Understanding the Different Types of Bond Yields - Investopedia This value is determined using the coupon payment, the value of the issue at maturity, and any capital gains or losses that were incurred during the lifetime of the bond. YTM estimates typically ...

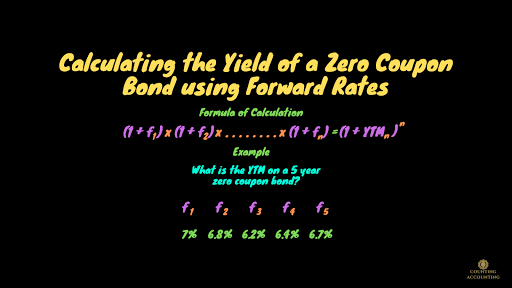

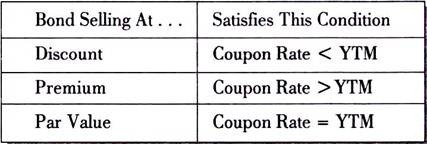

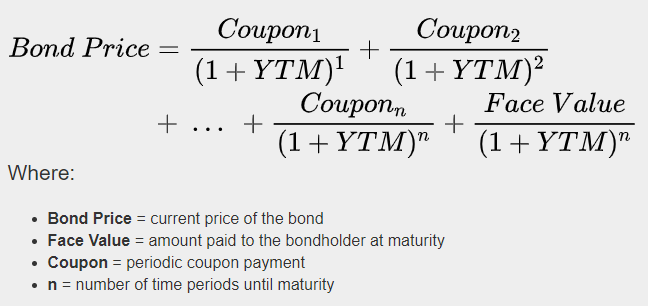

Ytm for coupon bond. Current Yield vs. Yield to Maturity - Investopedia Bond Yield As a Function of Price . When a bond's market price is above par, which is known as a premium bond, its current yield and YTM are lower than its coupon rate.Conversely, when a bond ... Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity. The n is the number of years from now until the bond matures. Yield to Maturity vs. Holding Period Return: What's the Difference? The formula for calculating YTM, if done correctly, should account for the present value of the bond's remaining coupon payments. The YTM formula can be seen as follows: Zero Coupon Bond: Calculate the YTM (yield to maturity) - BrainMass Consider a zero-coupon bond with a $1000 face value and 10 years left until maturity. If the bond is currently trading for $459, what is the yield to maturity on this bond? Show calculations. Please show all calculations with.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Bond YTM Calculator | Yield to Maturity The bond yield to maturity formula needs five inputs, which you can find in our bond YTM calculator: face value - Face value of the bond; bond price - Price of the bond; coupon rate - Annual coupon rate; frequency - Number of times the coupon is distributed in a year; and. n - Years to maturity. Difference Between Coupon Rate and Yield to Maturity The coupon rate remains the same throughout the bond tenure year, while Yield to Maturity (YTM) changes with the period left for the bond maturation and also on the current market value of the bond. The coupon rate represents the interest payment rates that are to be received annually by the bond receiver. Current bond price, YTM, coupon rate, real rate of interest - BrainMass Ackerman Co. has 9 percent coupon bonds on the market with nine years left to maturity. The bonds make annual payments. If the bond currently sells for $934, what is the YTM? Ashes Divide Corporation has bonds on the market with 14.5 years to maturity, a YTM of 6.8 percent, and a current price of $924. The bonds make semiannual payments.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. What is Bond - Meaning, Types & YTM Calculation Process - Scripbox Yield to maturity (YTM) is one of the ways to price bonds. It is the total expected return for an investor if the bond is held to maturity. ... For a zero coupon bond, the YTM is calculated using the formula below: However, most of the bonds in the market pay an interest (coupon payment). Hence to estimate YTM, one can also use a trial and ... en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Consider a 30-year zero-coupon bond with a face value of $100. If the bond is priced at an annual YTM of 10%, it will cost $5.73 today (the present value of this cash flow, 100/(1.1) 30 = 5.73). Over the coming 30 years, the price will advance to $100, and the annualized return will be 10%. What happens in the meantime? Bonds- Price, YTM, Duration - BrainMass US Treasury Notes Coupon Yield to Maturity Zero coupon rate. 1 Year 3.25% 3% 3%. 2 Year 3.80% 3.25%. 3 Year 4.5% 3.5%. 4 Year 5% 4%. 5 Year 6% 4.5%. You can assume that coupon payments are annual and that you are pricing on a coupon day (no accrued interest) and you may ignore basis conventions. You should make your process and methodology ...

› bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price.

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 4.25%, compared to 4.18% the previous market day and 2.00% last year. This is lower than the long term average of 4.36%.

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond YTM Example Consider a $1,000 zero-coupon bond that has two years until maturity . The bond is currently valued at $925, the price at which it could be purchased today.

› coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

Calculate YTC and YTM for a 20 year coupon bond - brainmass.com What are the YTC and YTM for a 20-year, 8% Semiannual coupon bond selling for $1,225, which can be called in 5 years for $1,085? What is the effective YTC? Would you expect to earn YTM or YTC on this bond and why? Also, show the formula and entries on a financial calculator.

moneychimp.com › articles › finworksBond Yield to Maturity (YTM) Formula - Moneychimp One thing to notice is that the YTM is greater than the current yield, which in turn is greater than the coupon rate. (Current yield is $70/$950 = 7.37%). This will always be true for a bond selling at a discount.

Bonds- YTM, coupon rate, interest rate risk - BrainMass What is the coupon rate on the bond then? The YTM? 3. Interest Rate Risk: Bond J is a 4 percent coupon bond. Bond K is a 12 percent coupon bond. Both bonds have eight years to maturity, make semiannual payments, and have a YTM of 7 percent. If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds?

Basis Point Value - Overview, Bond Yields and Prices Summary. Basis point value of a bond is a measure of the price volatility of bond prices to 0.01% or 1 basis point change in its yield. Bond yields and their prices share an inverse relationship. Factors such as yield to maturity, coupon rate, and face value impact the relationship between the yield and price of the bond.

Understanding the Different Types of Bond Yields - Investopedia This value is determined using the coupon payment, the value of the issue at maturity, and any capital gains or losses that were incurred during the lifetime of the bond. YTM estimates typically ...

How to Calculate YTM of a Bond in Excel (4 Suitable Methods) 4. Utilize IRR Function to Calculate YTM of a Bond. Let's consider another dataset for this method. The dataset is shown in the next picture. I will use IRR Function to get the YTM value of a Bond.The IRR Function returns the internal rate of return by taking values from the dataset as arguments.Then, the YTM will be found after multiplying no of coupons per year with the IRR value.

Difference Between Bond Yield and Yield to Maturity In short, a bond yield shows the annual income of investment, whereas yield to maturity is the total predicted yield on a bond till its date of maturation. Bond Yield, or commonly known as yield, designates the revenue return on the bond. In short, a bond yield is calculated by dividing coupon amount (interest) by the price.

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "42 ytm for coupon bond"